Submitting CORC Adjustment Claims: Timely Filing Guidelines

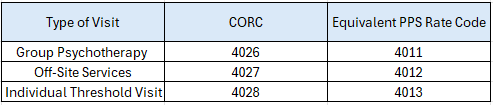

As a result of the CHCANYS lawsuit, New York State has established court-ordered rate codes (CORC) to allow FQHCs to recoup their full Medicaid PPS rates for claims that were improperly denied by MCOs (for example, claims denied due to the provider being out of network). These rate codes – often referred to as shortfalls – ensure that FQHCs receive their full PPS rate. Below is a list of CORCs, along with their corresponding PPS rate codes.

In response to advocacy by CHCANYS with DOH and CMS, FQHCs were permitted as of August 2023 to retroactively bill for court-ordered rate codes dating back to October 1, 2016. All claims needed to have been submitted by November 28, 2023, with allowances for correcting and resubmitting any denied claims until January 19, 2024.

In March, DOH confirmed that all CORC resubmission claims had been processed, totaling over $39 million to health centers. However, some centers reported denials for previously paid wrap claims that were eligible for CORC shortfall payments. For instance, a claim that received a wrap payment but was eligible for a CORC—due to an MCO’s denial for an out-of-network provider—was subsequently denied because it had already been adjudicated and paid. To secure the full PPS rate, an adjustment claim should have been submitted (or the original claim voided and a new CORC claim submitted). Many health centers did not complete this necessary adjustment process.

We have discussed this issue with DOH, and they have confirmed that adjustments are allowed for up to six years from the date of service.

What this means for you: If you have claims that were initially paid as wraps but are eligible for a CORC (shortfall), you are entitled to submit an adjustment claim to correct the rate code to a CORC using delay reason code 3. This is applicable even if you did not submit a claim during the original CORC resubmission period from August 29, 2023 to November 28, 2023. Please note that you must submit an adjustment claim because voiding the original claim and billing a new one does not qualify for the 6-year timely filing period.

Please reach out to dtobia@chcanys.org with any questions.